Launching a startup is an interesting and multi-component task that requires attention and careful preparation. One of the key obstacles faced by business visionaries is finding sources of startup financing. After all, even if the idea of a future business is incredible and entrepreneurs already have a plan, they need a good financial base to implement it.

Even at the stage of developing a business plan, the team should identify sources of economic support. After all, it is the effectiveness of the developed financial strategy that determines how the business idea can be implemented and what results are obtained upon completion.

Depending on their creative approach, startup owners choose different methods of financial support, and often these are quite classic and even outdated options. However, today the business sector offers new and creative ways to raise money. In the following, we will discuss several of these options in more detail.

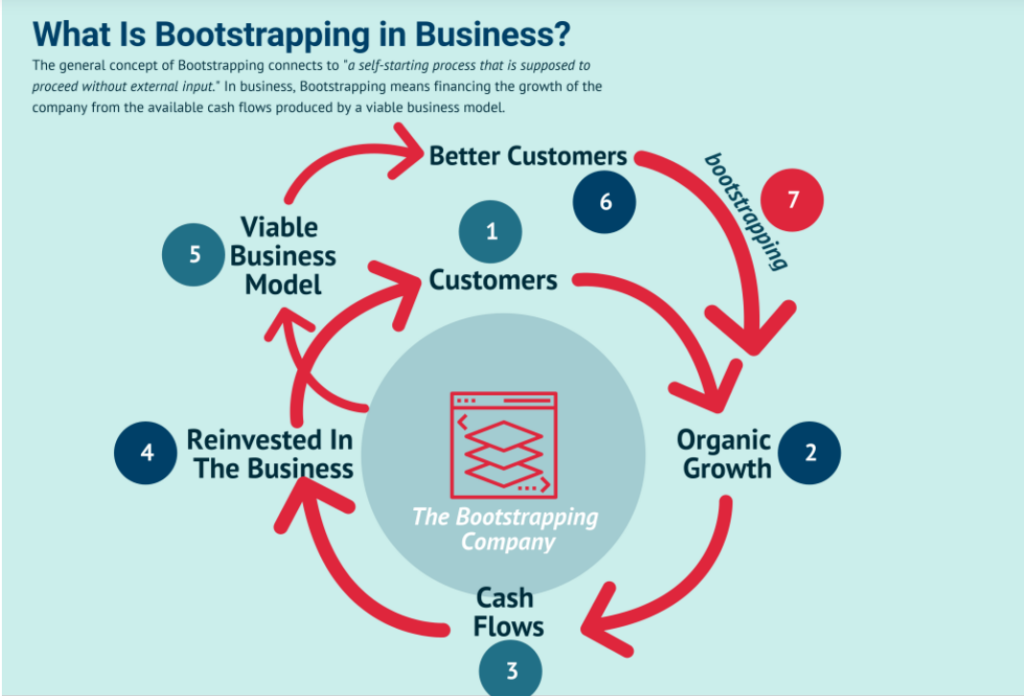

Bootstrapping: Self-Sufficiency in Funding

One of the concepts of financing a startup project is bootstrapping. This concept refers to the art of self-financing a startup. The basis of the personal financing method is based on the fact that the business owner independently finances the startup, using, for example, his savings. Without any loans, external investments, or shareholder support.

The main bootstrapping benefits are as follows:

- The self-sufficiency of this method means that you invest as much money in your project as you see fit. In the future you will be able to easily return the invested funds and receive a positive profit from your successful business.

- Independence from third-party investors. Bootstrapping financing allows you to use the existing cash flows that you operate with. Therefore, it allows you to maintain centralized control over the options for their distribution and spending.

- Cost-effectiveness. Given the fact that the startup owner has only one personal source of funding, this encourages the founder to spend money more efficiently. Careful financial management will become a generally useful skill for future activities.

However, not every startup founder has sufficient savings to launch a fully autonomous project from the start. In this case, they turn to additional lending. Such credit lines allow them to form a more stable financial basis to launch the project and repay the loan in installments.

The Supportive Network: Friends, Family, and Fools

Another method of economic support that is right next door to you is friends and family funding. It is quite interesting that every potential entrepreneur can find additional financial support at home. Why is this method promising to use? It’s simple:

- Affordable: you don’t have to engage in lengthy negotiations with your family, unlike outside shareholders who need to be interested.

- Convenient: family and friends will want to support your business endeavors on their own if they see you have the necessary passion and a promising idea.

However, even so, you need to remember that this is a business collaboration. Even if your family and friends are close enough to you that you can trust them without any problems, it is still better to discuss all legal issues and tell them about the borrowing risks. They should realize that a startup is a project for the future.

The Professional Route: Loans, Angels, and VCs

More professional methods of financing include options such as credit and venture capital financing, as well as the angel support method. All three of these methods have one thing in common: they involve raising additional funds from outside. However, this involvement occurs in different ways:

- Business loans allow a startup developer to receive additional financial support from a bank. The bank sets the terms of the loan, for example, it specifies the interest rate, prescribes the conditions for the implementation and repayment of the loan, and so on.

- Angel investors invest in an idea on a purely professional basis. Angel investors can enter into an agreement to repay the amount provided after the business has been realized.

- Venture capitalists support startups with high potential. They directly count on the profit they can make as a result. Venture capital funds can provide additional funding in exchange for equity or ownership.

Representatives of these methods, in particular venture capitalists and angel investors, can also provide strategic support: they can provide consultations, advice, and recommendations on how to form a strategic development model.

Innovative Financing: Crowdfunding and Incubators

Some startup entrepreneurs choose to use crowdfunding and incubators. Both of these methods are aimed at raising funds and helping a startup idea “get on its feet.”

Startup incubators are special organizations that help “grow” an idea and provide it with the capacity (including financial) for development. Crowdfunding, on the other hand, is one of the most creative ideas for finding finance, based on the fact that the funds for the project are provided by initiative and caring investors. There can be several of them, so the startup founder collects small parts of the funds into a common, large bank.

Representatives of these methods of startup support are interested in making your business thrive and enter the global market with high capacity. Therefore, you can count not only on money but also on strategic advice and practical solutions.

Conclusion: Matching Your Startup with the Right Financing Model

There are many models of financial support for startups. Each has its specifics and advantages. If you are a representative of a startup project and want to realize your idea in the best possible way, the best option is to contact funding consultants. They will be able to professionally assess the potential, analyze important factors, and offer the best option for financing model alignment based on the defined startup goals.